Financing the Next Frontier: Liquid Infrastructure Fuels Broadband Expansion in Arizona

Althea’s Liquid Infrastructure is redefining how broadband, cellular and infrastructure networks are funded by turning physical assets into blockchain-backed, revenue-generating digital instruments. Rather than relying on slow-moving grants or rigid bank loans, Liquid Infrastructure combines tokenized real-world assets (RWA), programmable finance, and instant revenue distribution to create a transparent, automated ecosystem for financing connectivity at scale.

Kamui Finance, a pioneer institutional investor in tokenized real world assets, led the investment backing the first large scale deployment in Liquid Infrastructure. The support of Kamui Finance represents growing institutional confidence in tokenized finance solutions.

“The Althea and Hawk Networks teams’ innovative, blockchain-based solution provides exactly the kinds of advantages we seek when investing in tokenized and on-chain finance. Transparent, predictable and automated distributions derived daily from infrastructure provide a higher level of investment security than typically available in traditional finance structures. We are proud to be able to support the deployment of Liquid Infrastructure RWA and support them in their future growth” said Hadi Kabalan, Director at Kamui Finance.

Why a New Model Was Needed

Despite billions in federal and state broadband programs, many communities remain underserved. Traditional funding sources like grants, subsidies, and bank credit often come with delays, rigid terms, and bureaucratic hurdles that small and mid-sized ISPs struggle to navigate.

Broadband is one of the fastest-growing infrastructure sectors in the U.S., with market growth projected at ~10% annually, yet operators with strong customer loyalty and localized expertise are routinely locked out of capital markets. Althea’s Liquid Infrastructure closes this gap by making digital networks as investable and trackable as traditional financial assets—unlocking growth potential for both funders and operators.

How It Works

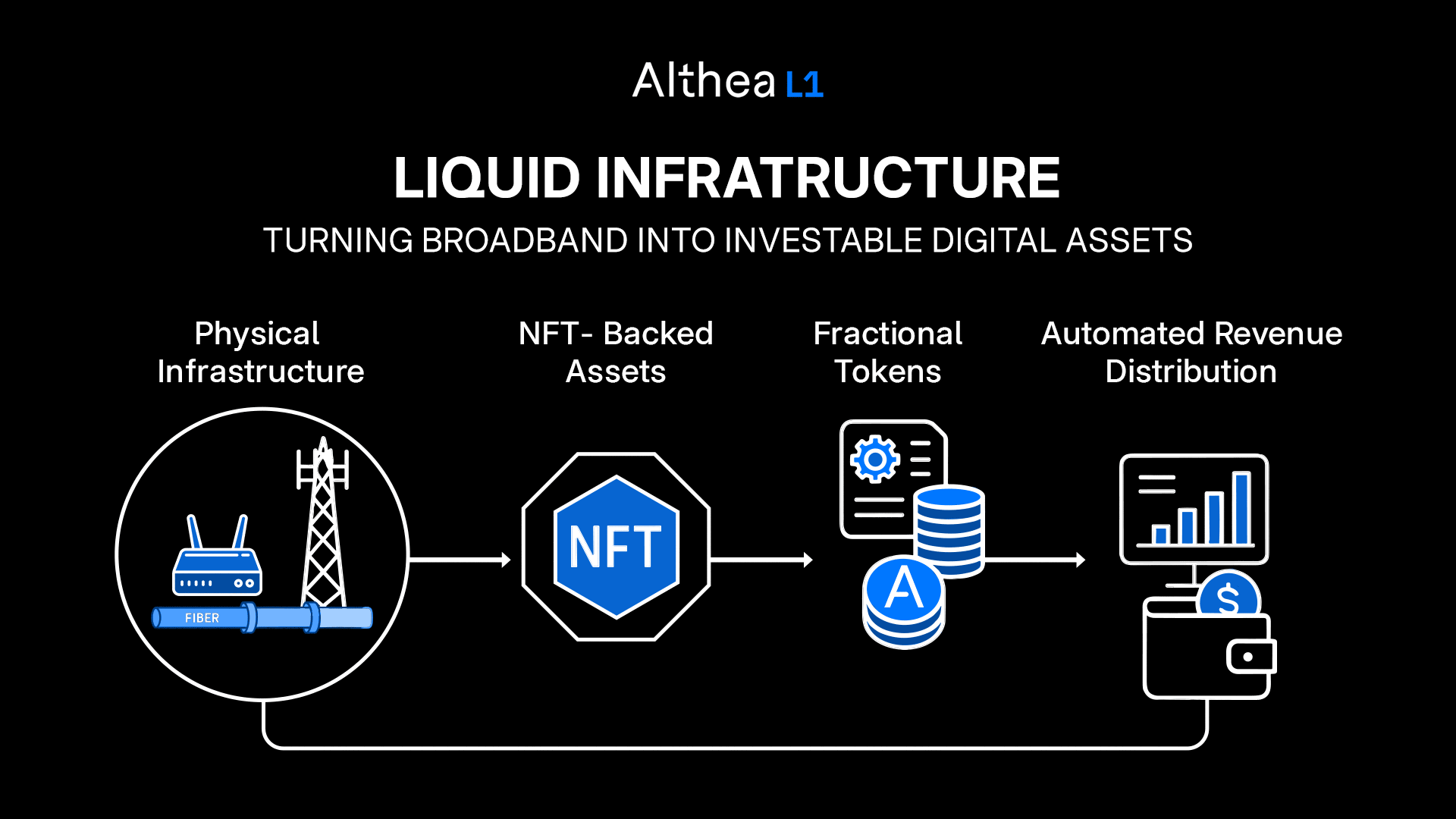

Liquid Infrastructure is a suite of blockchain-based tools that transform physical networks—fiber routes, towers, routers—into programmable financial assets:

- NFT-Backed Assets: Each network or utility asset is represented by a non-fungible token (ERC721 NFT) on the Althea L1 blockchain, anchoring its identity and revenue stream on-chain.

- Fractionalization via Smart Contracts: The Liquid Infrastructure Smart Contract (LISC) fractionalizes the NFT into fungible tokens, allowing multiple investors to share in top-line revenue.

- Machine-to-Machine Billing: Althea’s payment system automatically collects user payments and distributes funds directly to token holders in near real-time.

- Keystone Liquidity Platform: Hawk Networks’ interface for viewing performance metrics, claiming revenue, and managing tokens brings transparency and accessibility to both operators and investors.

- Non-Custodial & Trustless: Smart contracts are non-upgradable and verifiable, giving investors direct control over their tokens and earnings without intermediaries.

Arizona Case Study

In Southern Arizona, a regional ISP with ~1,000 subscribers near a large market was able to scale operations and upgrade technology using Liquid Infrastructure. Hawk Networks leveraged blockchain-powered transparency and on-chain mechanics into tokenized RWA backed by institutional investors led by Kamui Finance to super-charge growth, add value to users and derive superior returns on investment.

“What’s exciting about this model is that we can now align investment with impact. Local ISPs keep their identity and autonomy, while investors gain confidence from blockchain-level transparency. It’s a win for communities and capital,” said Deborah Simpier, CEO of Hawk Networks.

This approach has already accelerated the rollout of advanced connectivity solutions like KeyLTE/5G and Althea Mobile, proving Liquid Infrastructure’s value as a financing model for high growth areas.

Why It Matters

- For Investors: Liquid Infrastructure offers access to a $3T+ infrastructure market with unparalleled visibility and automated risk management.

- For Operators: Smaller ISPs finally have access to scalable, flexible funding that doesn’t compromise their independence.

- For Communities: This model prioritizes local agency and governance, while enabling faster deployments, with happier, more long-term customers.

Liquid Infrastructure shows that infrastructure can be financed as dynamically as it’s used, transforming broadband, utilities, and smart-city services into programmable financial ecosystems.