How Smart Contracts on Blockchain Can Bring Broadband to All

Written by Isfandiyar Shaheen, founder of NetEquity, and shared with permission

The short answer:

- Smart contracts on blockchain make revenue share contracts possible between stakeholders of a broadband network.

- Revenue share contracts reduce the amount of risk capital required to build and operate a broadband network.

- Reducing dependence on risk capital makes it feasible for stakeholders to absorb demand risk.

- Demand risk reduction makes it possible to deploy broadband networks in underserved areas.

The longer answer: Broadband is as essential as electricity or water but is not as widespread. For context, 100% of homes in the U.S. have electricity and water but tens of millions do not have access to affordable broadband even though demand for broadband clearly exists. The unmet demand for broadband was clearly demonstrated during the COVID-19 induced lockdowns when stories of students doing homework in parking lots outside McDonalds started emerging.

So what is the fundamental difference between incentives of traditional infrastructure like electricity versus broadband? It boils down to demand risk.

Broadband investors assume demand risk when building infrastructure. Electricity or water utility investors assume no demand risk when building infrastructure.

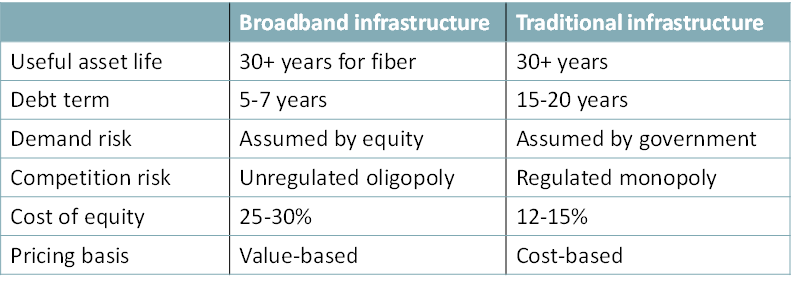

Economic incentives of broadband infrastructure versus traditional infrastructure

To understand why unmet demand for broadband exists, let’s compare the economic incentives of broadband infrastructure with traditional infrastructure.

1. Revenue generation: Traditional infrastructure businesses like electric utilities generate revenue by earning a fixed rate of return on assets deployed in a regulated market and not by selling units of electricity. Broadband businesses generate revenue by selling units of data or leasing their infrastructure to other providers in a competitive market.

2. Profit distribution: Broadband investors generate 5–10x more profits in dense urban areas versus rural areas. Traditional infrastructure investors are mostly agnostic to population density because they earn a fixed rate of return based on assets deployed. Assets on which traditional infrastructure investors can earn a return is known as Rate Base or Regulated Asset Base.

3. Performance benchmarks: Traditional infrastructure investors will keep earning a return so long as their assets remain available for use subject to pre-agreed performance benchmarks like SAIDI (System Average Interruption Duration Index). Broadband investors have no such performance benchmarks because, in theory, broadband businesses operate in a competitive market.

4. Demand and competition risk: Broadband investors assume 100% of demand and competition risk whereas traditional infrastructure investors assume negligible competition and demand risk after infrastructure is deployed.

As a result, broadband infrastructure investors cannot obtain long-term debt financing the way traditional infrastructure investors can.

5. Investor objective: Broadband investors aim to deploy the least amount of resources to generate the maximum profit for shareholders. Traditional infrastructure investors aim to deploy the maximum amount of capital so long as Rate Base grows.

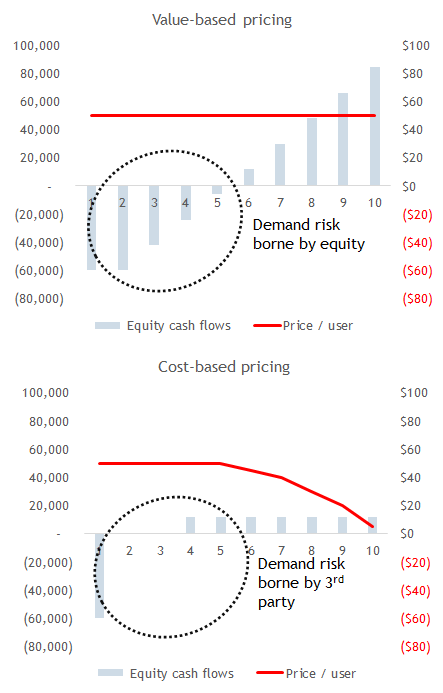

6. Customer pricing: Traditional infrastructure offers cost-based pricing to its customers because traditional infrastructure investors assume limited demand risk and therefore agree to a regulated rate of return. Cost-based pricing, as the name suggests, is price determined by what service delivery actually costs. Under cost-based pricing, the price paid per user should decline as the number of users increases.

In contrast, broadband infrastructure investors offer value-based pricing to their customers. Value based pricing is the price determined by a customer’s ability to pay for a service. Under value-based pricing there is no incentive to reduce prices other than competition risk. In the charts below, the x-axis represents years of operation and corresponding increase in customers.

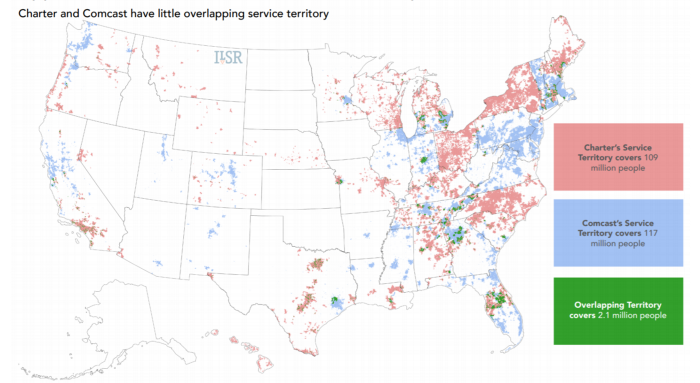

Value-based pricing can work out well for customers in a competitive market. Unfortunately, in many countries, broadband competition risk is mostly theoretical. For example, in the United States, there are over 70 million people who have only one Internet Service Provider (“ISP”) serving them. When ISPs operate as a duopoly there is limited incentive to deliver better service to customers.

What does a smart contract for broadband infrastructure look like?

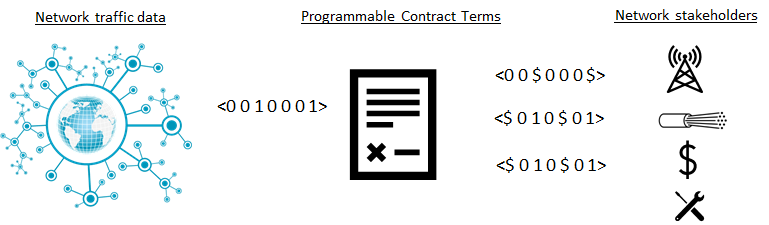

A smart contract is a computer program or a transaction protocol that needs no external action to execute the terms of a contract. A smart contract for broadband infrastructure uses network traffic data to make programmatic payments to network stakeholders.

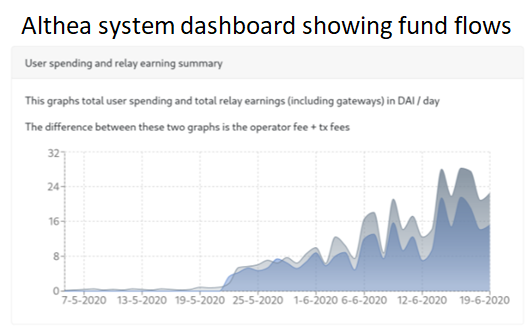

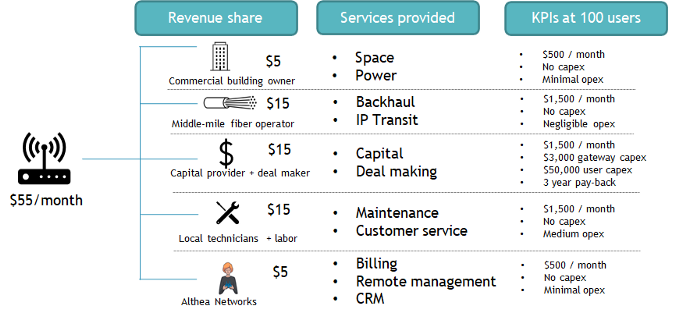

An example of a smart contract for telecom and broadband has been built by Althea Networks. To date, Althea has used this system to build 14 broadband networks in underserved areas including one network in Abuja, Nigeria.

To get Internet service, an Althea user (“User Node”) loads money in their Althea router through a credit/debit card. The Althea router converts this payment to stable digital currency (“stablecoin”) that is pegged to the US dollar.

This stablecoin follows a price-aware protocol to make payments to Network Stakeholders. Network Stakeholders include neighboring customers (“Relay Node”), middle-mile fiber operators, building owners, cell tower owners, network technicians, capital providers, equipment suppliers, and spectrum owners. See the Althea Whitepaper for more details.

Payments made through the Althea system are programmable, visible to all stakeholders, and auditable on a public blockchain. This level of transparency makes it possible for any Network Stakeholder to join a revenue share smart contract in a trust-minimized way.

The Althea blockchain is secured by validators holding the Althea governance token (“ALTG”). ALTG token holders earn 10% of transaction fees flowing through a network as compensation for maintaining trust between Network Stakeholders.

Without Althea, a revenue share contract expects a Network Stakeholder to trust an Internet Service Provider (“ISP”) in two ways:

- Honesty with revenue figures

- Compliance with timely payments

Establishing and maintaining this level of trust is costly and time consuming which is why most ISPs end up signing fixed payment contracts with Network Stakeholders. Per such agreements, an ISP assumes 100% of demand and competition risk which in turn increases the amount of risk capital required to build a network. If this ISP makes a mistake in forecasting demand it will incur financial losses. Fear of losses causes ISP investors to become overly conservative and ignore rural and underserved areas.

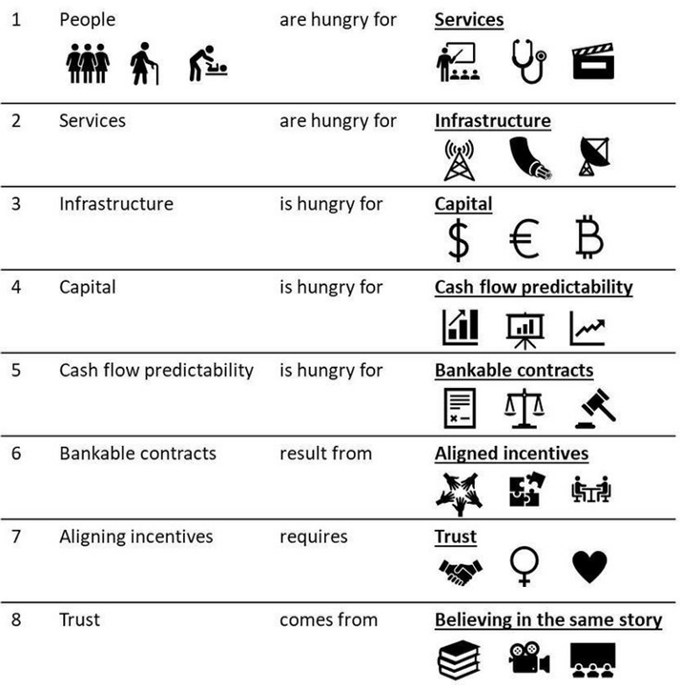

Broadband is a necessity and every human is hungry for it. However, broadband is hungry for infrastructure. That infrastructure is hungry for capital. Unlocking capital requires predictable cash flows, bankable contracts, aligned incentives, and most importantly, trust. Smart contracts on a blockchain make it feasible to maintain trust between stakeholders.

How to build a broadband network with Althea

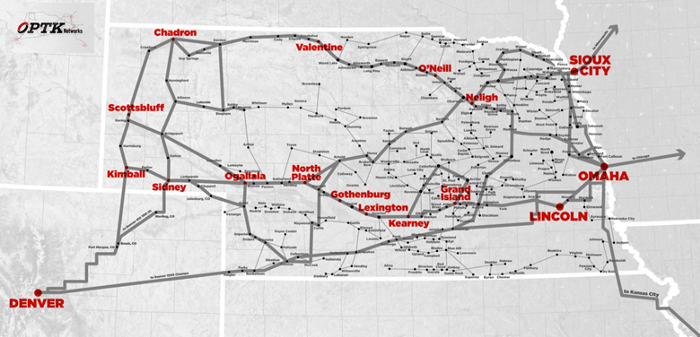

Step 1: Find a cell tower operator or middle-mile fiber operator (“InfraCo”) willing to enter in a revenue-share smart contract. OPTK Networks in Nebraska is one such InfraCo. OPTK’s fiber network spans over 10,000 miles and is present at several thousand points of presence (“PoPs”). These PoPs can be commercial buildings, cell towers, water towers or similar vertical assets.

Step 2: Obtain a list of PoP owners and inquire which of those owners are willing to enter into a revenue share contract.

Step 3: Invite private investors or equipment suppliers to fund/contribute Gateway Nodes and User Nodes against a revenue share. A single Gateway Node costs $3,000 and a User Node costs $500 in the U.S. Show private investors/equipment suppliers simple unit economics of a single Gateway Node at 100 users.

Step 4: Construct Gateway Nodes at PoPs where the building/tower owner is willing to enter into a revenue-share contract.

Step 5: Start marketing to users living within 1–2 miles of a Gateway Node. Encourage users to self-finance User Nodes and achieve bill reductions.

Step 6: When a user signs up, send a technician to their home, install equipment and activate service.

Important to note that, other than marketing expense which also gets capitalized, there are zero operating costs in the above structure.

A user’s monthly spend on Internet service will depend on data usage. For the average user, this will be $55/month if the user chooses to not pay for the home equipment themselves (see Metered Bandwidth by Justin Kilpatrick for more). A single Gateway Node can support at least 100 users. Unit economics of a single Gateway Node are as follows.

To incentivize local ownership of broadband infrastructure, offer Internet users bill reductions if they self-finance a User Node. A user’s bill reduction is determined by the Network Users and Total Capital Deployed. For example, if there are 100 Network Users and 1 Gateway Node, Total Capital Deployed is $53,000. In this example, bill reduction calculation will be as follows:

- User capex as / Total Capital Deployed = $500 / $53,000 = 0.94%

- Monthly fee for Capital Providers at 100 users = $1,500

- Monthly bill reduction = 0.94% X $1,500 = $14.1/month

- Net monthly bill = $41/month

Estimating global potential

Globally there are 4.96 million cell towers that provide mobile Internet coverage to the entire world, yet there are over 3 billion people who cannot access the Internet. Majority of these cell towers have excess capacity available to host Gateway Nodes at zero marginal cost through a revenue share smart contract.

At present, over 70% of these cell towers are owned by tower sharing companies or InfraCos while 30% are owned by telecom operators. InfraCos are incentivized to maximize tower utilization and tower cash flows but struggle to find creditworthy ISP customers as tower tenants in underserved locations. InfraCos also have full time network technicians on payroll who can do installations and maintenance.

If an InfraCo (eg Crown Castle, American Tower, Cellnex et al), a wireless equipment manufacturer (eg Ericsson, Ubiquity, Siklu, Parallel Wireless et al) and a marketing agency entered into a revenue share smart contract, they could build a broadband network without any upfront risk capital. Such networks will be able to operate profitably at much lower prices than a traditional ISP because they will not have to account for equity investor dividends, debt repayments or management salaries. Such networks can make it feasible to serve billions of people who live within a mobile Internet coverage area but are still not online.

For a further deep dive - check out the latest Althea community call with Asfi, Deborah and Justin - https://youtu.be/-Q-3-vXtyUE.