Resilient and Sovereign Infrastructure Is the Next Frontier for Fintech

While much of fintech focuses on applications—payments, wallets, digital banking—a deeper shift is happening beneath the surface. The next frontier isn't in app design or user onboarding. It's in the infrastructure itself.

Telecom systems—fiber, radios, routers—have long been treated as utilities. They move data, but they’ve had no agency, no embedded logic, and no role in finance. That’s no longer sustainable. If fintech is to reach its full potential—truly global, decentralized, and programmable—it needs infrastructure that can match that ambition.

Thanks to technology like Althea, today's networks are empowered to operate like economic agents. They can earn revenue, repay capital, split payments among stakeholders, and dynamically price services, all without human oversight. What was once passive infrastructure now plays an active role in creating and exchanging value.

We refer to this as resilient and sovereign infrastructure: networks that can govern, finance, and sustain themselves. It is infrastructure with financial logic built into the foundation.

iFi: When Infrastructure Becomes Financially Aware

Web3 takes the traditional fintech principles to new levels of autonomy and cooperation across a global landscape. At Althea, we’ve taken that concept further by developing a framework for Infrastructure Finance, or iFi.

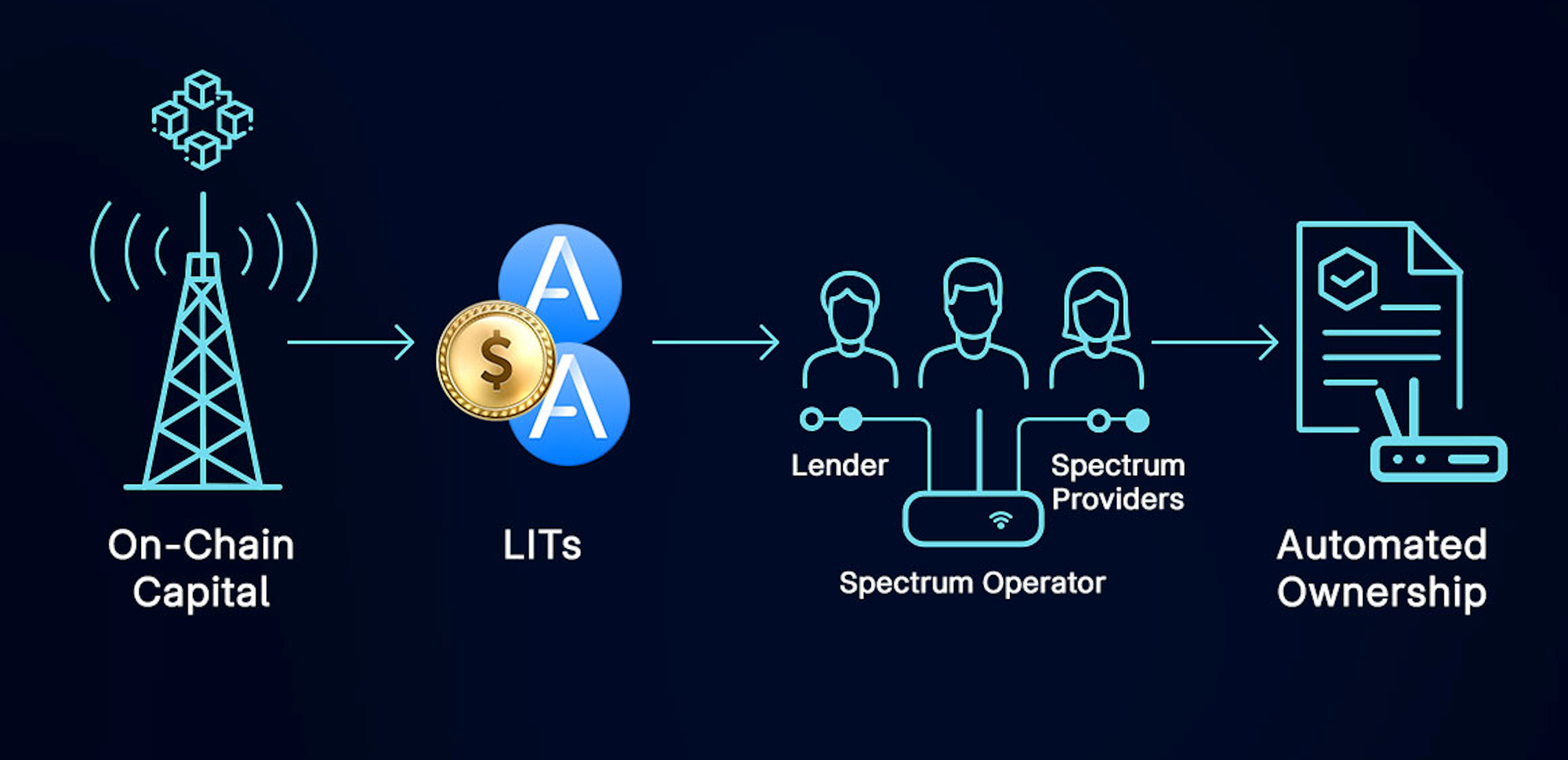

Here’s how it works in practice:

- A telecom network, such as a rural cellular deployment, is funded using on-chain capital.

- These funders receive Liquid Infrastructure Tokens (LITs), which entitle them to a share of that network’s future revenue.

- As users pay for service, the network streams small payments directly to all stakeholders: lenders, spectrum providers, equipment partners, and operators.

- Once the target repayment is met, control of the asset shifts automatically—no manual billing, no reconciliation delays.

Each LIT is backed by actual usage and tied to the economic activity of a working network. These tokens reflect real performance, not speculation.

The Network Keeps the Books

Legacy infrastructure relies on layers of billing departments, contracts, and delayed settlements. Funds often move more slowly than the services they are intended to support.

Althea’s model removes those frictions. Revenue splits, debt repayment, and capital recycling are handled directly by the network itself. A router can send payments upstream as soon as a user connects. A radio can track its own payback schedule and fulfill it automatically. A network can continuously adjust how earnings are distributed based on performance, demand, or updated terms, without requiring human input.

With financial intelligence woven into the infrastructure layer, Althea enables systems to adapt, scale, and support new services as conditions evolve.

Building the Right Rails: The iFi DEX

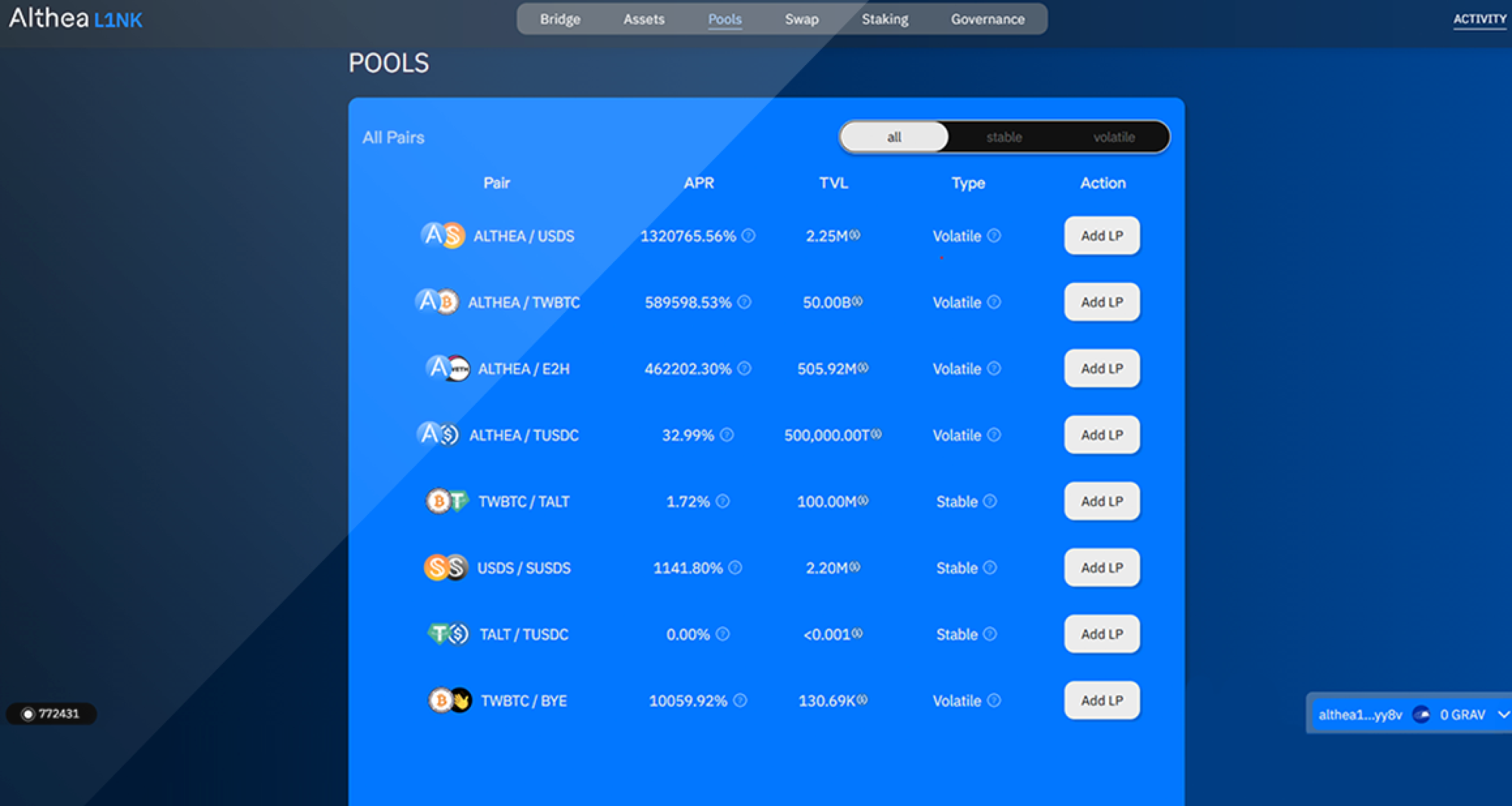

To support this model of autonomous finance, we developed the iFi DEX, a decentralized exchange designed explicitly for infrastructure tokens, bandwidth markets, and machine-to-machine payments.

Off-the-shelf DEXs weren’t built for these kinds of users. Routers, sensors, and radios aren’t speculators—they need simple, predictable tools to manage cash flow and liquidity.

The iFi DEX is designed for that environment. It enables:

- Swaps of stablecoins and other revenue

- Real-time revenue distribution to token holders

- Programmatic settlement for services purchasing bandwidth

It also supports gasless transactions and stable, yield-bearing assets—critical features enabling machines, not just human traders, to interact with financial markets.

What This Unlocks

6G is often noted as the evolution that brings intelligence to the edge of connectivity. It enables dynamic and programmatic features on the radio that directly connect to the device. Instead of performing complex logic or operations at the data center or cloud, operations can be performed in real time, improving latency and maintaining the security and sovereignty of the data.

Combined with Althea’s embedded financial design, we can envision key performance unlocks, such as dynamic spectrum sharing, supply chain tracking, or private cellular networks owned by multiple stakeholders.

By embedding finance directly into the network’s operation, we make it possible to deploy high-performance infrastructure with less overhead, faster coordination, and a clear path to return on investment.

We’re already seeing this approach in action across apartment buildings, tribal lands, remote agricultural corridors, and dense urban environments. These aren’t pilots. These are active, growing networks built on principles of local ownership, open finance, and technological resilience.

Real Yield, Real Assets, Real Sovereignty

Infrastructure is no longer just a cost center or public utility. It’s becoming an asset class with programmable cash flow, clear performance metrics, and built-in governance.

This model changes who can deploy networks, how capital is raised and repaid, and the role connectivity plays in global finance.

The financial systems of tomorrow won’t just depend on infrastructure. They’ll be built directly inside it.