The Gravity well: Pulling DeFi capital to Cosmos

Migrating years of infrastructure and onboarding from Ethereum is a hard climb. Using Gravity, well, it's as easy as falling.

A gravity well is the pull of gravity that a large body in space exerts. The larger the body (the more mass) the more of a gravity well it has. The Sun has a large (or deep) gravity well. Asteroids and small moons have much shallower gravity wells. Anything on a planet or moon is considered to be at the bottom of the gravity well. Entering space from the surface of a planet or moon means climbing out of the gravity well, something that often takes a huge amount of energy. The larger a planet or moon's gravity well is, the more energy it takes to achieve escape velocity and blast a ship off of it.

The Althea team along with other core Cosmos contributors chose the name 'Gravity', the logo, and imagery very intentionally for Gravity Bridge to represent the force drawing utility toward the Cosmos Hub. Gravity DEX, and all other future products coming together under the Gravity umbrella are destined to expand and enrich the utility of the Cosmos Hub and the wider ecosystem, strengthening the pull of Gravity even further.

The goal is as straightforward as it is ambitious. To build a force as inevitable as gravity. A force that pulls capital to the Cosmos Hub and IBC-enabled chains. You don't do this by forcing people to move their capital. Migrating years of infrastructure and onboarding from Ethereum is a hard climb.

Using Gravity, well, it's as easy as falling.

Execution context sharing

Gravity Bridge unlocks enormous amounts of currently inaccessible capital on the Ethereum chain by providing a shared execution context on Ethereum, governed by the Cosmos Hub.

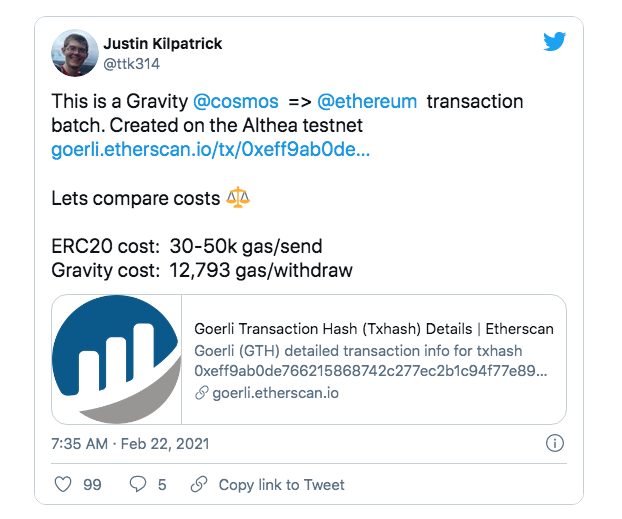

21000 gas is charged for any transaction as a “base fee”. This covers the cost of an elliptic curve operation to recover the sender address from the signature as well as the disk and bandwidth space of storing the transaction. -- Ethereum Design Rationale

By using the external consensus of the Cosmos Hub blockchain to package a single Ethereum transaction out of many different users' operations, every operation becomes 21,000 gas cheaper than if it had been run individually.

We've already seen how Gravity Bridge can perform cheaper ERC20 sends. But Gravity Bridge can also execute batches of arbitrary contract calls. The value of arbitrage opportunities on Ethereum is driven by gas prices. All trades on Ethereum are arbitraged up to the point where the gas cost exceeds the value of the rewards.

Lower gas prices create hundreds of millions of dollars of arbitrage opportunities. This creates more traffic, which raises gas prices, which washes away potential arbitrage profits, eventually resulting in an equilibrium.

So what happens when we slash that cost across the board? Millions of dollars of trade opportunities that were previously unreachable become accessible.

Using the aggregate efficiency of the Gravity Bridge's shared execution context, provided by the Cosmos Hub validator set, this efficiency is possible and accessible to everyone. This creates a favorable situation for participants on either side of the bridge as the extra efficiency allows DeFi to do more.

Minted rewards

Gravity Bridge brings unprecedented power to the stakeholders of a Cosmos chain by giving them the ability to mint tokens as a relayer reward, effectively providing a gas subsidy fueled by inflation of the Cosmos chain's native token.

On its own, using inflation to drive Ethereum traders to the Cosmos side of the bridge is simply an unsustainable growth hacking strategy. But when combined with context sharing it becomes a feedback loop.

It's as easy as falling

A gravity well is a feedback loop. A star brings in mass, which increases its gravitational pull, which allows it to bring in more mass. The Cosmos Hub has the 'mass' required to generate an enormous feedback loop. Gas subsidies drive more users to access Ethereum DeFi via the Cosmos Hub and Gravity Bridge.

More bridge users drive lower gas costs through execution context sharing. Lower gas costs open up millions of dollars of Ethereum arbitrage opportunities that are only accessible via the Cosmos Hub.

As this loop repeats, the gravity well grows stronger, drawing more users and capital to the Cosmos Hub. Gravity Dex gains volume, becoming a vast marketplace that grows in value as more assets are moved on to it, driving all Cosmos native DeFi, and further enhancing the capital advantages of being on the Hub.

"It's one of the strongest ways to add more utility to the Cosmos Hub," enthuses Tendermint CEO, Peng Zhong. "The interchain Gravity DEX connected to Ethereum via Gravity Bridge will attract new chains to start trading and creating liquidity, traders to start arbitraging, and developers, who now have a new path to start listing their tokens permissionlessly and getting people to invest."

All of this increases the pull of the Cosmos Hub and takes us back to the first step of this virtuous cycle.

Timelines

Protocol Audit: We are working with Infomal Systems to have a protocol audit complete in early to mid June.

Hub signaling proposal: Submit signaling proposal for Gravity on the Cosmos hub with the audit in early to mid June

Gravity bridge/Althea testnet: The unincentivized testnet will be online with our new changes this week, as we prep for the incentivized testnet.

Althea has been hard at work making this vision a reality and bringing Gravity to the Cosmos Hub and our own chain.

We believe in building cooperative systems that bring people together for the benefit of every user and we extend that principle beyond the internet and into financial services.

Our dream is to use the Gravity Well to drive enormous capital efficiency for our Althea internet users. Lowering the cost of onboarding and increasing Althea users access to financial services.