Gravity Bridge - V2

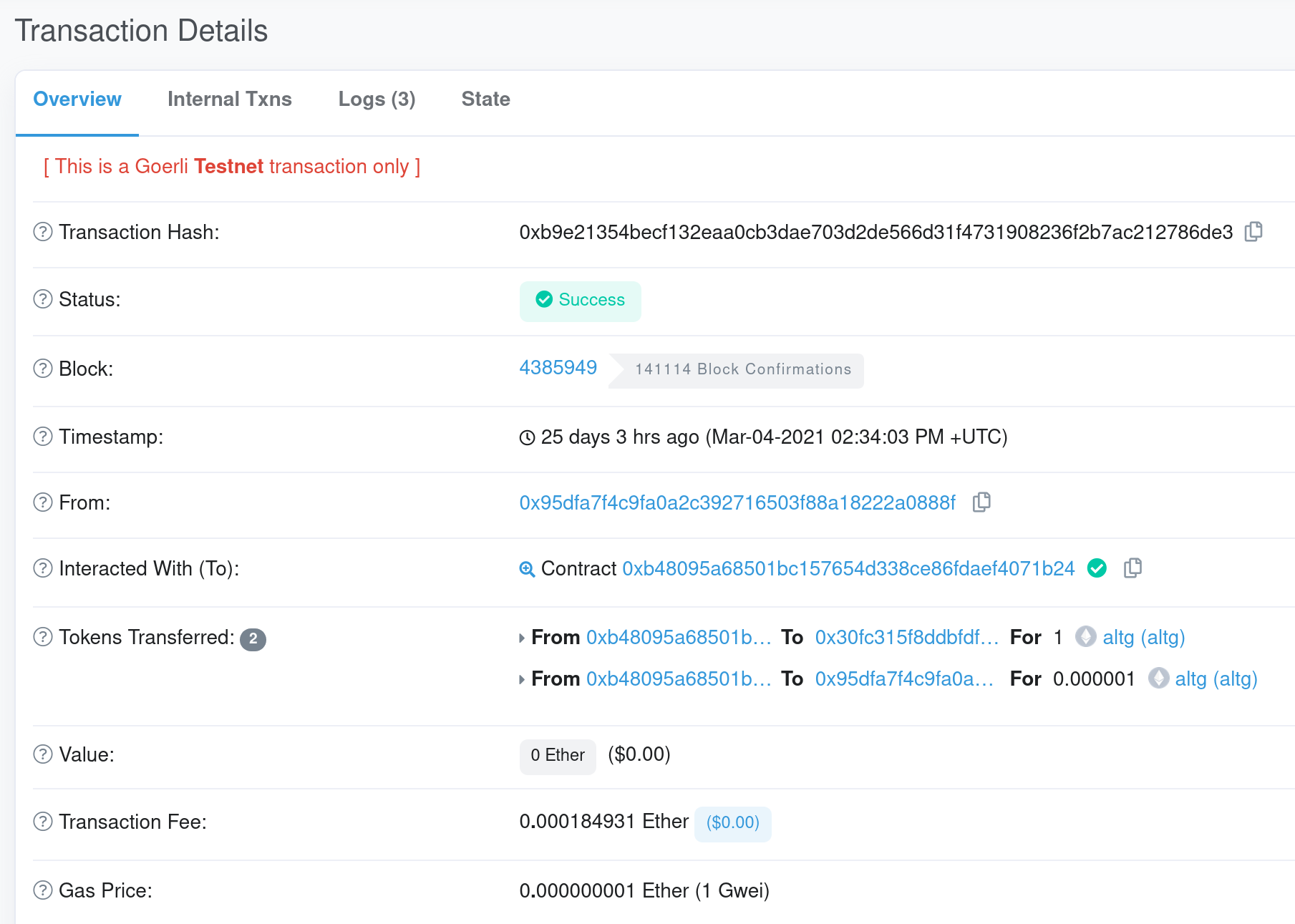

Althea is excited to announce the completion and test of the first transaction of a Cosmos based token (ALTG) to test ethereum (Goerli) using the second iteration of Althea Gravity, the Cosmos <> Ethereum bridge!

Althea is excited to announce the completion and test of the first transaction of a Cosmos based token (ALTG) to test Ethereum (Goerli) using the second iteration of Althea Gravity, the Cosmos <> Ethereum bridge! Earlier this year, Althea began testing the Gravity bridge sending Ethereum to Cosmos and back again. This additional functionality of the bridge enables Cosmos native assets and Atoms to be sent to Ethereum addresses and to DEXs like Uniswap, all with significant gas savings.

Althea’s core principles of open, interoperable telecom systems inform everything we do, including the work on the Gravity bridge. The interoperability between Cosmos chains with IBC and the Gravity bridge's interoperability between Ethereum and erc20 tokens opens new possibilities and market opportunities. In Althea, users currently load up their routers using a debit card and a simple Wyre plugin, seamlessly onboarding liquidity which then routes through a bridge to xdai, where Althea’s router-to-router payments account for over 70% of the volume of micro-transactions of the xdai network. Now, the Gravity bridge will onboard this liquidity through Ethereum to the Althea blockchain and the Cosmos ecosystem empowering the world's bandwidth users to not only have choice and ownership of their internet, but also leverage their liquidity to work for them.

Gravity’s batching enables extremely gas efficient transactions from Ethereum to Cosmos and back again, enabling a variety of exciting DeFi implementations, including the work of Sommelier and it’s “coprocessor to Ethereum”. Liquidity Providers (LPs) will be able to use the Sommelier to author and execute complex, and automated transactions, such as portfolio rebalancing, limit orders, batched orders, as well as a host of other features that traders have come to expect from CeFi, but that are not currently available in DeFi.

Justin Kilpatrick, Althea CTO and co-founder, remarks “Gravity is the first bridge efficient enough to *work with* Ethereum DeFi rather than just 'bring it somewhere else'. It's cheaper to do your trades through Gravity than it is to just use Ethereum.”

Because batched Gravity transactions share an execution context they can avoid the base fee that every Ethereum transaction pays to be processed by the network. For the vast majority of DeFi operations the base transaction fee (21,000 gas) makes up nearly half of all gas used.

With Gravity V2, native Cosmos assets can be bridged to Ethereum, which will make it easy for projects to launch a new blockchain with Starport and sell their tokens on Uniswap. Gravity v2 can also be used to compensate relayers using a chain's native token. No Cosmos chain can print more DAI, but it can obviously mint more of it’s own native token. Subsidizing gas with Gravity V2 could fundamentally change the financial dynamics of using a bridge and allow for fee-free transactions for users.

Gravity will also interact with upcoming Cosmos DEXs like B-Harvest’s Gravity DEX, coming as soon as Q2 this year!

The possibilities of Gravity and the multi-chain future are numerous. The open and interoperable future of connectivity and finance is here and we are excited to be contributing to that ecosystem.

*****

We have just concluded a series of test nets, with the next upgrade to pre-production and iteration planned for later this week. Incentivized test nets to follow. We had a large number of participants in these early test nets which allowed us to experience different edge cases.

Check Twitter or Discord for updates.

Join us on Discord - https://discord.gg/jnYg8dd

Twitter @Altheanetwork